If you have the time-tracking feature, in addition they use this app to clock out and in. And since ADP RUN is a part of the larger ADP ecosystem, you presumably can mix add-on features along with your payroll system for a complete HR suite. In Style ADP RUN add-ons include time monitoring, advantages administration and more. ADP’s payroll app additionally permits integration with lots of of apps for enhanced functionality and customization. Sometimes, payroll systems let users view and download data by time frame, worker or location.

No, whereas direct deposit is the quickest and most common technique, QuickBooks Payroll permits you to pay employees by way of direct deposit or with paper checks that you just print your self. Sure, you presumably can change to QuickBooks Payroll mid-year, however it’s going to require significantly more setup work. Gusto is usually cited as being more user-friendly on the HR aspect and in the course of the preliminary setup process.

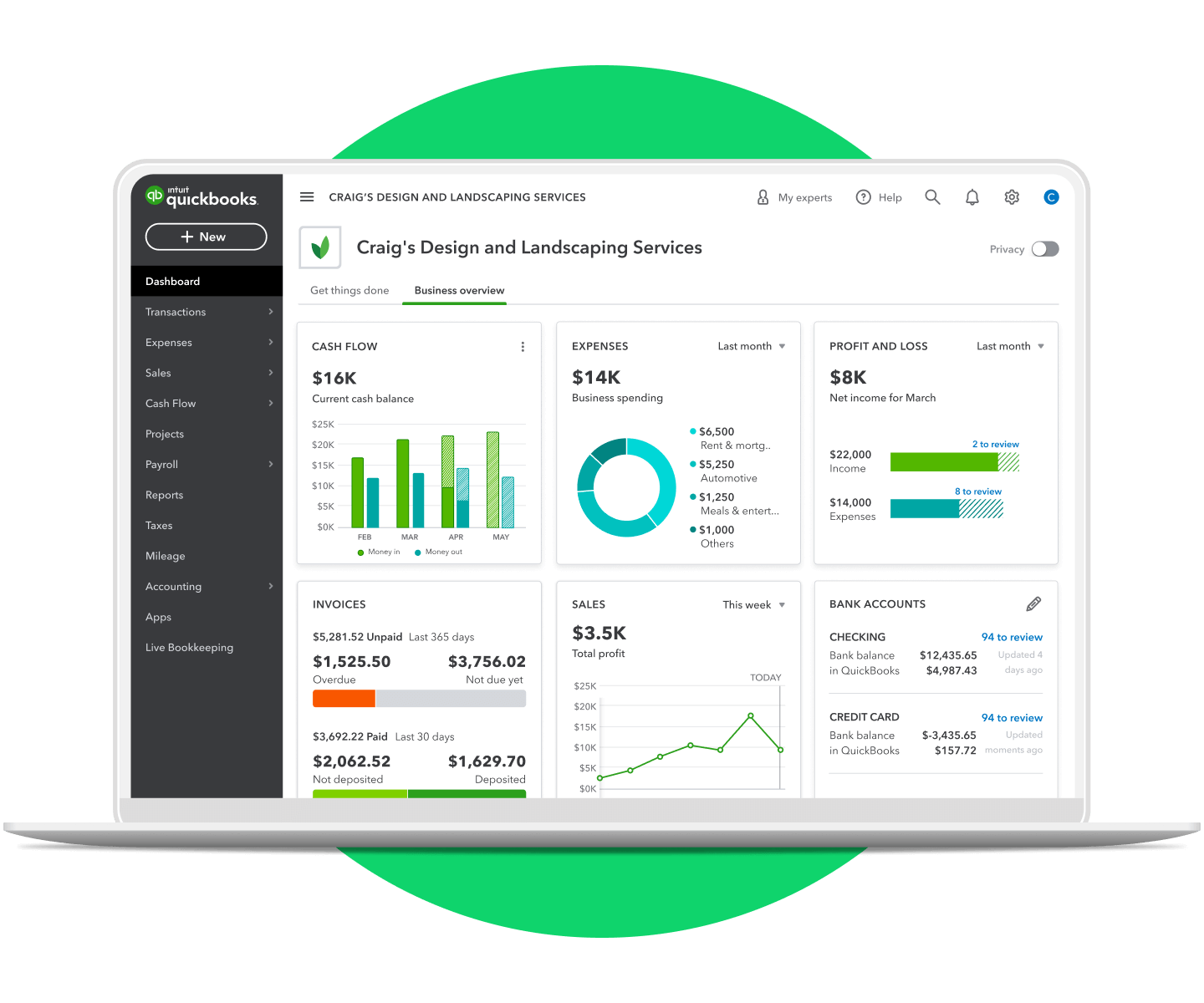

Small companies which are in search of a streamlined resolution for complex payroll tasks will respect QuickBooks Payroll’s capabilities. Though the options differ by plan, all tax and payroll processing companies integrate seamlessly with Intuit’s accounting software. One of my favourite things about QuickBooks Payroll is how customizable it’s. You can choose the features and services that best go properly with your corporation, whether or not it’s HR assist, well being benefits, or time tracking. Furthermore, QuickBooks Payroll automatically generates W-2 types and fills in necessary data for 1099s, which it then transmits electronically. Employers can also addContent IRS notices they’ve acquired into QuickBooks Payroll and receive assistance and updates on the notice’s standing.

Most full-service payroll suppliers will mechanically file taxes on your behalf. QuickBooks Payroll calculates, files and pays state and federal taxes. Nevertheless, QuickBooks Payroll Core doesn’t assist automated funds or filings for local taxes, and companies that file in a couple of state will want to pay $12 per thirty days for every additional state. Multistate tax filings value intuit online payroll extra solely with the Core and Premium plans; Elite customers don’t pay an extra fee. Beginning at $40 per 30 days plus $6 per particular person per 30 days, Gusto stands out as payroll software that puts an emphasis on HR and employees.

QuickBooks Payroll addresses common points such as calculating payroll taxes, submitting tax types, and keeping up with new payroll necessities. Key features embody automated tax calculations, employee direct deposits, and real-time payroll reviews. The QuickBooks desktop payroll subscription offers alternatives to add on options like HR assistance, 401k plans, employee advantages, and workers’ compensation. In QuickBooks Payroll evaluations, users discover that it simplifies the payroll course of releasing up time to give consideration to other aspects of the business.

Standout Options (25% Of Final Score)

- Users praise the app for its ease of use, data-syncing capabilities and the reality that employees can use it to log time worked.

- You’ll also get payroll reports on each employees and contractors.

- You pay a premium for it, but you’re paying for peace of thoughts and having experts do the heavy lifting for you.

- As you possibly can see, for a 10-person team, the Premium package deal ends up being significantly cheaper than shopping for Core and then adding the mandatory time monitoring individually.

- With the mixing feature, companies discover it extremely simple to handle payroll duties and maintain observe of expenses.

That means if you’re already utilizing some of the company’s software, you’ll be ready to share data between apps. It’s really easy to see why Intuit still manages to rule the roost with so many businesses opting to use its suite of products. Sure plans, like Payroll Premium and Elite, supply 24/7 professional help for an upgrade, which is best than having to wait for office hours if you run around the clock. Payroll Core + Essentials only provides a few more options for $125 per thirty days, while Payroll Premium + Plus is a much fuller bundle, but for a $203/month premium. Business owners are at all times on the lookout https://www.quickbooks-payroll.org/ for better, extra efficient methods to do issues. When it comes to accounting, payroll and all of these other every day admin duties, a solution just like the high-profile QuickBooks makes plenty of sense.

Full-service Tax Filing—the Huge Relief

We’ll arrange your payroll for you with QuickBooks Payroll Elite. With QuickBooks Payroll Premium, we’ll evaluation your setup to verify every thing is correct. QuickBooks On-line Payroll works for small to midsize businesses—from accountants and monetary experts to hospitality companies, construction companies, and truckers.

They can also automate I-9 compliance to simplify the onboarding process. No matter which plan you select, employees can entry their pay stubs and other essential data via the workforce portal. As A Outcome Of each QuickBooks Payroll model contains Intuit’s employee workforce portal, adding new staff members or updating information is simple.

This is a streamlined resolution with loads of potent options and functions that allow quick and straightforward management of office tasks. Prospects can use the help hub as their first port of call for everyday questions. Thankfully, that $6.50 per person monthly fee is similar throughout all packages.

If you have budget constraints, you could also look at the free payroll apps obtainable. QuickBooks Payroll helps independent contractor payroll and keeps observe of when, what and how much for every contractor payment. It mechanically imports needed knowledge and prepares 1099s that you just must obtain and e mail to the contractors. Please notice that that is available as a separate QuickBooks function. You can arrange direct deposit, or you’ll have the ability to select to print physical paychecks instantly from your printer using the QuickBooks system.